A Mutual Omnibus Account Opening Agreement Has Been Signed Between MKK and Kazakhstan Central Securities Depository (KCSD)

Merkezi Kayıt Kuruluşu (MKK) and Kazakhstan Central Securities Depository (KCSD) establish bilateral direct links to enhance access to domestic government debt markets in Türkiye and Kazakhstan.

Türkiye’s central securities depository and trade repository, Merkezi Kayıt Kuruluşu A.Ş. (MKK), and Central Securities Depository of Kazakhstan (KCSD) will establish a bilateral direct link between the two CSDs. The connection will enable settlement and custody of domestic government debt securities in both countries via omnibus accounts opened within MKK and KCSD, providing market participants with efficient and secure access to Turkish and Kazakhstani instruments.

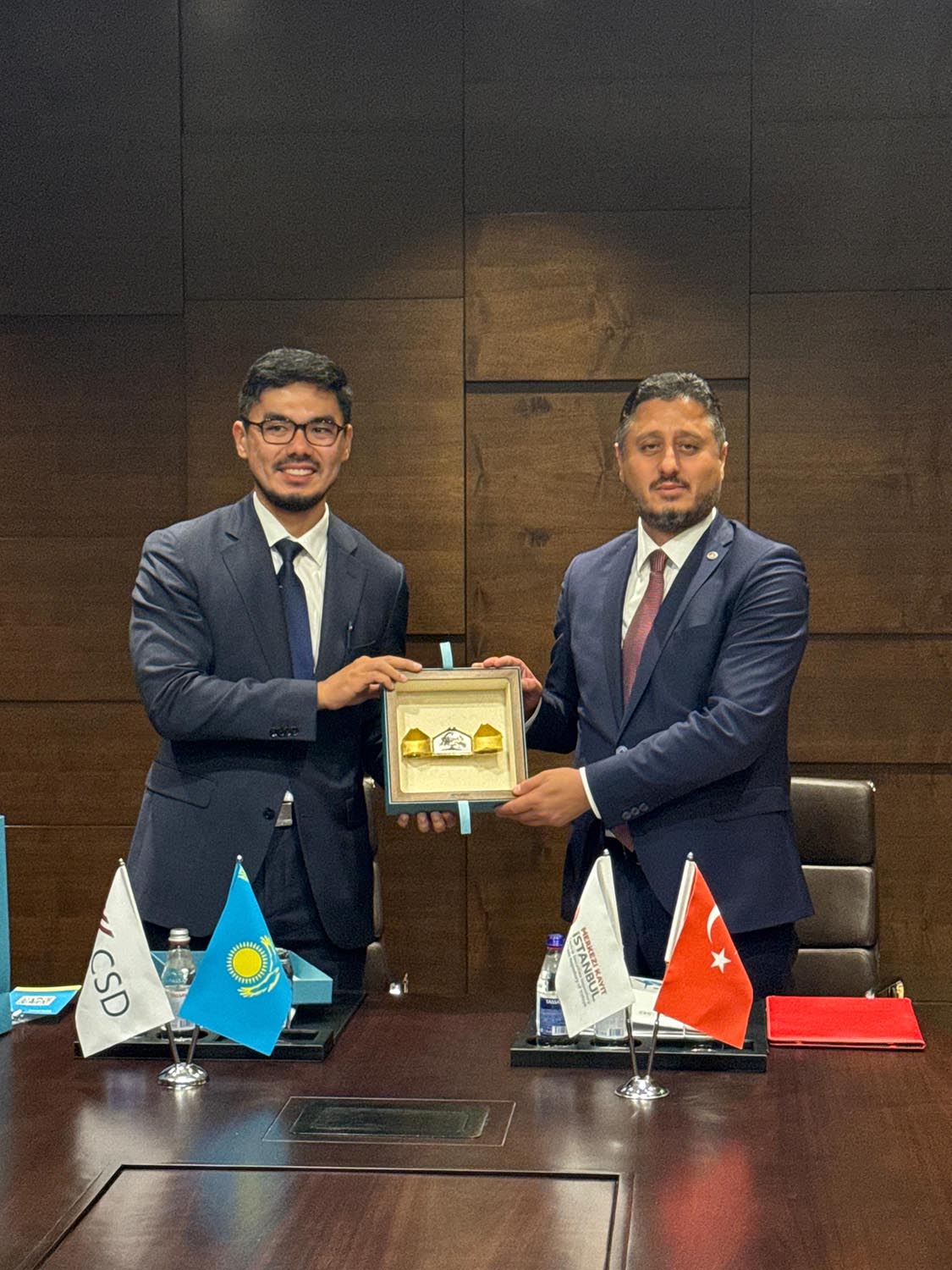

MKK and KCSD have signed the membership and account-opening agreements during the WFC Forum 2025. The operational go-live will follow the completion of technical onboarding. The bilateral structure allows eligible investors to hold and settle government debt securities through omnibus accounts, improving post-trade efficiency, reducing operational frictions, and broadening cross-border participation. Designed to support liquidity formation, the link will further strengthen integration between the two markets.

Yedil MEDEU, Chairman of KCSD, commented: “This cooperation with MKK creates new opportunities for Kazakhstani investors to directly access Türkiye’s government bond market, while also welcoming Turkish investors to our capital market. It will not only expand cross-border investment opportunities but also enhance post-trade efficiency and foster deeper cooperation between our capital markets.”

Dr. Ekrem ARIKAN, CEO and Board Member of MKK, stated: “This direct inter-CSD link with our brother country Kazakhstan’s CSD (KCSD) extends the regional connectivity we have built and supports our objective of connecting with market infrastructures of the region. Following our 2021 bilateral link with Azerbaijan’s CSD (MDM), KCSD link marks the next step toward integrating markets across the Organization of Turkic States. It advances our strategic objective to connect with all market infrastructures of the member countries and supports the development of a future common infrastructure for the Organization. By enabling reciprocal omnibus access to government debt securities, we expect to simplify participation, enhance post-trade efficiency and liquidity, and broaden international investor engagement across both countries and the wider region.”